Use this resource to complete the questions on the Poverty and the distribution of income in Australia – Data analysis worksheet.

Table 1: Income share of Australian households 2015–16

|

Income share |

% |

|---|---|

|

Lowest quintile |

7.7% |

|

Second quintile |

12.5% |

|

Third quintile |

17.0% |

|

Fourth quintile |

23.0% |

|

Highest quintile |

39.8% |

|

All households |

100.0% |

Source: Australian Bureau of Statistics, 6523.0 – Household Income and Wealth, Australia, 2015–16

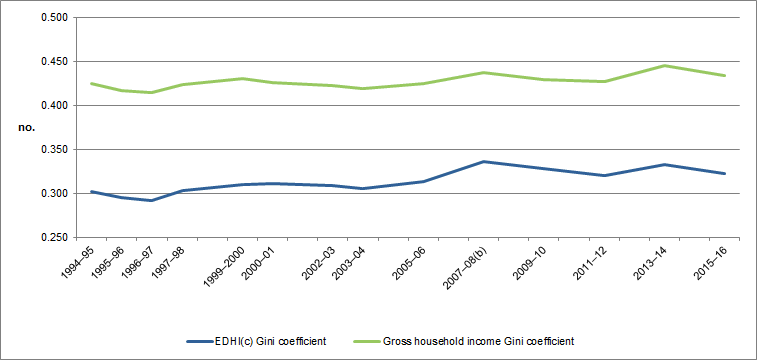

Figure 1: Income Gini coefficient 1994–95 to 2015–16[1]

Source: ABS: 6523.0 - Household Income and Wealth, Australia, 2015–16

Table 2: Poverty Lines: Australia, March Quarter, 2018[2]

|

Income unit (Head in workforce) |

Including housing ($ per week) |

Other than housing ($ per week) |

|---|---|---|

|

Couple |

$693.78 |

$507.43 |

|

Couple plus 1 |

$833.96 |

$630.75 |

|

Couple plus 2 |

$974.14 |

$754.08 |

|

Couple plus 3 |

$1,114.32 |

$877.41 |

|

Couple plus 4 |

$1,254.50 |

$999.37 |

|

Single person |

$518.63 |

$349.03 |

|

Single person plus 1 |

$665.82 |

$479.37 |

|

Single person plus 2 |

$805.90 |

$602.70 |

| Single person plus 3; |

$946.08 |

$726.03 |

| &single person plus 4 |

$1,086.26 |

$849.35 |

Source: Melbourne Institute: Applied Economic & Social Research, Poverty Lines: Australia, March Quarter 2018

Table 3: Number of households by income range 2015–16

|

Equivalised disposable income per week |

Number of households |

Proportion of total number of households |

|---|---|---|

|

Negative income |

19,600 |

0.22 |

|

No income |

13,200 |

0.15 |

|

$1–99 |

92,400 |

1.03 |

|

$100–199 |

48,300 |

0.54 |

|

$200–299 |

87,800 |

0.98 |

|

$300–399 |

159,200 |

1.78 |

|

$400–499 |

598,900 |

6.68 |

|

$500–599 |

359,400 |

4.01 |

|

$600–699 |

401,600 |

4.48 |

|

$700–799 |

398,700 |

4.45 |

|

$800–899 |

341,400 |

3.81 |

|

Total |

2,520,500 |

28.1 |

Source: ABS: 6523.0 – Household Income and Wealth, Australia, 2015–16

Table 4: Comparison of Henderson Poverty Lines with the income of adults who receive maximum welfare payments and have no other income, March Quarter 2018

Part A: Married couple

|

Income unit |

Basic payment of person 1 |

Basic payment of person 2 (Partner) |

Family Tax Benefit Part A |

Family Tax Benefit Part B |

Rent Assistance |

Total Income |

Poverty Line |

|---|---|---|---|---|---|---|---|

|

Allowee |

$251.70 |

$251.70 |

0.00 |

0.00 |

$63.50 |

$566.90 |

$693.78 |

|

Pensioner |

$342.05 |

$342.05 |

0.00 |

0.00 |

$63.50 |

$747.60 |

$595.69 |

|

Couple plus 1 |

$251.70 |

$251.70 |

$93.17 |

$26.24 |

$79.17 |

$701.98 |

$833.96 |

|

Couple plus 2 |

$251.70 |

$251.70 |

$186.34 |

$26.24 |

$79.17 |

$795.15 |

$974.14 |

|

Couple plus 3 |

$251.70 |

$251.70 |

$279.51 |

$50.12 |

$89.39 |

$922.42 |

$1,114.32 |

|

Couple plus 4 |

$251.70 |

$251.70 |

$400.68 |

$50.12 |

$89.39 |

$1,043.59 |

$1,254.50 |

Part B: Single person

|

Income unit |

Basic payment of person 1 |

Basic payment of person 2 (Partner) |

Family Tax Benefit Part A |

Family Tax Benefit Part B |

Rent Assistance |

Total Income |

Poverty Line |

|---|---|---|---|---|---|---|---|

|

Allowee |

$277.30 |

- |

0.00 |

0.00 |

$67.40 |

$344.70 |

$518.63 |

|

Pensioner |

$453.80 |

- |

0.00 |

0.00 |

$67.40 |

$521.20 |

$420.54 |

|

Single person plus 1 |

$382.30 |

- |

$93.17 |

$55.30 |

$79.17 |

$609.94 |

$567.63 |

|

Single person plus 2 |

$382.30 |

- |

$186.34 |

$55.30 |

$79.17 |

$703.11 |

$707.81 |

|

Single person plus 3 |

$382.30 |

- |

$279.51 |

$79.17 |

$89.39 |

$830.37 |

$847.89 |

|

Single person plus 4 |

$382.30 |

- |

$400.68 |

$79.17 |

$89.39 |

$951.54 |

$988.17 |

Source: Melbourne Institute: Applied Economic & Social Research, Poverty Lines: Australia, March Quarter 2018

Table 5: Poverty lines by family type, 2015–16 ($ per week after tax, including social security payments)

|

Income unit |

50% of median income before housing costs |

60% of median income before housing costs |

50% of median income after housing costs |

60% of median income after housing costs |

|---|---|---|---|---|

|

Lone person |

$432.73 |

$519.28 |

$353.29 |

$423.94 |

|

Couple only |

$649.10 |

$778.92 |

$529.93 |

$635.91 |

|

Sole parent, 2 children |

$692.37 |

$830.85 |

$565.26 |

$678.31 |

|

Couple, 2 children |

$908.74 |

$1,090.48 |

$741.90 |

$890.28 |

Source: Davidson, P., Saunders, P., Bradbury, B. and Wong, M. (2018), Poverty in Australia, 2018. ACOSS/UNSW Poverty and Inequality Partnership Report No. 2, Sydney: ACOSS.

Table 6: Number and percentage of people below the 50% and 60% of median income poverty lines in 2015–16

|

|

50% of median poverty line |

60% of median poverty line |

|---|---|---|

|

Percentage of people below the poverty line |

13.2% |

21.1% |

|

Percentage of children below the poverty line |

17.3% |

25.5% |

|

Number of people below the poverty line |

3,051,500 |

4,885,200 |

|

Number of children below the poverty line |

739,300 |

1,087,500 |

|

Average poverty gap for those below the poverty line ($/week) |

$135.00 |

$206.00 |

|

Average poverty gap for those below the poverty line (% of poverty line) |

38% |

49% |

Source: Davidson, P., Saunders, P., Bradbury, B. and Wong, M. (2018), Poverty in Australia, 2018. ACOSS/UNSW Poverty and Inequality Partnership Report No. 2, Sydney: ACOSS.

Table 7: Rates of poverty - percentages of people from different groups living below poverty lines in 2015–16 (%)

Part A: All people

|

|

50% of median |

60% of median |

|---|---|---|

|

All people |

13.2% |

21.1% |

Part B: By age

|

|

50% of median |

60% of median |

|---|---|---|

|

Under 15 years |

17.3% |

25.5% |

|

15-24 years |

13.9% |

20.2% |

|

25-64 years |

12.1% |

17.6% |

|

65 years and over |

11.6% |

28.3% |

|

65 years and over, renting |

43.4% |

57.9% |

Part C: Children

|

|

50% of median |

60% of median |

|---|---|---|

|

Children in sole parent households |

39.4% |

52.3% |

|

Children in couple households |

13.1% |

20.1% |

|

Children in other households |

10.0% |

21.0% |

|

All children |

17.3% |

25.5% |

Part D: Family type

|

|

50% of median |

60% of median |

|---|---|---|

|

Single, no children (15-64 years) |

26.2% |

34.9% |

|

Couple, no children (15-64 years) |

18.0% |

46.5% |

|

Sole Parent |

32.0% |

43.2% |

|

Single, no children (64 years and over) |

9.6% |

13.2% |

|

Couple, no children (64 years and over) |

11.1% |

26.1% |

|

Couple, children |

11.9% |

18.3% |

|

Other |

7.1% |

11.6% |

Part E: By income source

|

|

50% of median |

60% of median |

|---|---|---|

|

Wage and salary |

6.9% |

11.5% |

|

Social security payment |

34.5% |

56.4% |

|

Other income |

14.9% |

17.5% |

|

By social security payment type |

50% of median |

60% of median |

|

Newstart allowance |

54.6% |

66.5% |

|

Youth allowance |

63.7% |

70.4% |

|

Parenting payment |

52.3% |

67.6% |

|

Disability support pension |

36.4% |

56% |

|

Carer payment |

17.1% |

42.1% |

|

Age pension |

12.2% |

31.5% |

|

All recipients |

25.6% |

44.1% |

Source: Davidson, P., Saunders, P., Bradbury, B. and Wong, M. (2018), Poverty in Australia, 2018. ACOSS/UNSW Poverty and Inequality Partnership Report No. 2, Sydney: ACOSS.

[1] The top line in figure 1 shows the Gini coefficient for gross household income (income before tax) and the bottom line shows the net household income (income after tax).

[2] All figures refer to income after tax.

Linked activity: