Scenario 1 - Hospitality worker

Scenario 3 - Apprentice tradesperson or trainee

Scenario 4 - Yourself (you will need a record of deductions you want to claim).

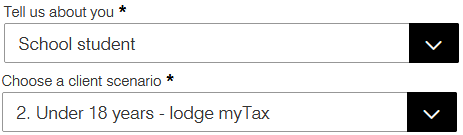

Scenario 1: Hospitality worker

So now you get to have a go at completing a tax return yourself. The ATO has an online services simulator for educational purposes. This includes myTax. Open the ATO Online services simulator and follow these instructions.

- Select the options above on the landing page and select Start.

- This is the home page of ATO online services. Before you complete a tax return, browse the information you can access from this page.

- In the For action box you will see an Overdue message. It tells you that this taxpayer’s tax return is overdue. Select the Prepare link to complete this tax return.

You are now in myTax.

Step 1: Contact details

This is where you update your details if necessary. Note that myTax pre-fills the information. It is your responsibility to check it is correct and change it if it is not.

- Select Next.

Step 2: Financial institution details

You need to make sure this information is accurate, because if you are owed a refund, it will be deposited directly into this bank account.

- Select Next.

Step 3: Personalise your return

This is where you can personalise your return so you only complete the parts relevant to you. Information that has been reported to the ATO will be pre-filled with the corresponding checkbox selected. You can check the information on the next screen to ensure it is accurate. You can also upload your information from the myDeductions tool in the ATO app if you have used it.

- Select Next

Step 4: Prepare your return

The ATO pre-fills information into myTax as it becomes available. You shouldn't rely solely on pre-filled information. You need to check all the information and add any missing information to ensure your tax return is accurate.

Income statements and payment summaries

- Select Add/Edit for income statements and payment summaries

- Enter 'Hospitality' in Occupation where you earned the most income

- Select HOSPITALITY EMPLOYEE - COOK from the drop-down box

- Select Save and continue

Deductions

You will now need to enter some items that are allowable tax deductions relating to your employment

- Select Add/Edit for Deductions to enter your deductions.

Add the following deductions to the tax return.

Deduction category Deduction type Amount Add: Work-related clothing, laundry and dry-cleaning expenses Select: Compulsory work uniform $120 Add: Work-related clothing, laundry and dry-cleaning expenses Safety boots

Select: Protective clothing

$124.45 Add: Work-related self-education expenses (The self-education maintained or improved a skill or specific knowledge required for your work activities as an employee) Select: Self-education type

- The self-education maintained or improved a skill or specific knowledge for your work activities as an employee

Select: General expenses

Enter: Course on safe food handling

$190.00 Add: Gift or donation Enter: Donation to the Salvation Army $40.00 - When you have entered your deductions, select Save and continue.

Medicare and private health insurance

You will notice a 'Required' message under Medicare and private health insurance.

- Select Add/Edit and under Medicare levy surcharge (MLS) select 'Yes' you are covered by private patient hospital cover.

- You will notice a Private health insurance policy has been pre-filled but has an error. Select the drop-down arrow.

- At the BUP policy line 1 section:

- Enter Tax claim code 'A'.

- Enter $400 as Your premiums eligible for Australian Government rebate.

- Enter $100 as Your Australian government rebate received.

- Select Benefit code 30

- Select Save and continue.

Calculate Tax Estimate and Lodge

- Check that all your details are correct Calculate to generate your Tax estimate. MyTax gives you an estimate of how much tax you will be refunded, or if you have a tax bill.

- You now tick a box to sign a declaration that the information you have entered, including the pre-filled information, is true and correct, that you included all your income and you have the necessary receipts and records, including proof of your deductions.

- Select Lodge and print the tax return.

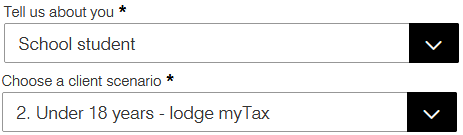

Scenario 2: Retail worker

So now you get to have a go at completing a tax return yourself. The ATO has an online services simulator for educational purposes. This includes myTax. Open the ATO Online services simulator and follow these instructions.

- Select the options above on the landing page and select Start.

- This is the home page of ATO online services. Before you complete a tax return, browse the information you can access from this page.

- In the For action box you will see an Overdue message. It tells you that this taxpayer’s tax return is overdue. Select the Prepare link to complete this tax return.

You are now in myTax.

Step 1: Contact details

This is where you update your details if necessary. Note that myTax pre-fills the information. It is your responsibility to check it is correct and change it if it is not.

- Select Next.

Step 2: Financial institution details

You need to make sure this information is accurate, because if you are owed a refund, it will be deposited directly into this bank account.

- Select Next.

Step 3: Personalise your return

This is where you can personalise your return so you only complete the parts relevant to you. Information that has been reported to the ATO will be pre-filled with the corresponding checkbox selected. You can check the information on the next screen to ensure it is accurate. You can also upload your information from the myDeductions tool in the ATO app if you have used it.

- Select Next

Step 4: Prepare your return

The ATO pre-fills information into myTax as it becomes available. You shouldn't rely solely on pre-filled information. You need to check all the information and add any missing information to ensure your tax return is accurate.

Income statements and payment summaries

- Select Add/Edit for income statements and payment summaries

- Enter 'Retail' in Occupation where you earned the most income

- Select RETAIL ASSISTANT - CASHIER from the drop-down box

- Select Save and continue

Deductions

You will now need to enter some items that are allowable tax deductions relating to your employment

- Select Add/Edit for Deductions to enter your deductions.

Add the following deductions to the tax return.

Deduction category Deduction type Amount Add: Work-related clothing, laundry and dry-cleaning expenses Select: Compulsory work uniform $120 Add: Other work-related expenses Enter: Union fees $195 Add: Work-related self-education expenses (The self-education maintained or improved a skill or specific knowledge required for your work activities as an employee) Select: Self-education type

- The self-education maintained or improved a skill or specific knowledge for your work activities as an employee

Select: General expenses

Enter: Course on customer service

$190.00 Add: Gift or donation Enter: Donation to Mission Australia $40.00 - When you have entered your deductions, select Save and continue.

Medicare and private health insurance

You will notice a 'Required' message under Medicare and private health insurance.

- Select Add/Edit and under Medicare levy surcharge (MLS) select 'Yes' you are covered by private patient hospital cover.

- You will notice a Private health insurance policy has been pre-filled but has an error. Select the drop-down arrow.

- At the BUP policy line 1 section:

- Enter Tax claim code 'A'.

- Enter $400 as Your premiums eligible for Australian Government rebate.

- Enter $100 as Your Australian government rebate received.

- Select Benefit code 30

- Select Save and continue.

Calculate Tax Estimate and Lodge

- Check that all your details are correct Calculate to generate your Tax estimate. MyTax gives you an estimate of how much tax you will be refunded, or if you have a tax bill.

- You now tick a box to sign a declaration that the information you have entered, including the pre-filled information, is true and correct, that you included all your income and you have the necessary receipts and records, including proof of your deductions.

- Select Lodge and print the tax return.

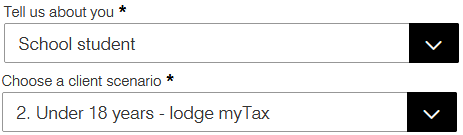

Scenario 3: Apprentice tradesperson or trainee

So now you get to have a go at completing a tax return yourself. The ATO has an online services simulator for educational purposes. This includes myTax. Open the ATO Online services simulator and follow these instructions.

- Select the options above on the landing page and select Start.

- This is the home page of ATO online services. Before you complete a tax return, browse the information you can access from this page.

- In the For action box you will see an Overdue message. It tells you that this taxpayer’s tax return is overdue. Select the Prepare link to complete this tax return.

You are now in myTax.

Step 1: Contact details

This is where you update your details if necessary. Note that myTax pre-fills the information. It is your responsibility to check it is correct and change it if it is not.

- Select Next.

Step 2: Financial institution details

You need to make sure this information is accurate, because if you are owed a refund, it will be deposited directly into this bank account.

- Select Next.

Step 3: Personalise your return

This is where you can personalise your return so you only complete the parts relevant to you. Information that has been reported to the ATO will be pre-filled with the corresponding checkbox selected. You can check the information on the next screen to ensure it is accurate. You can also upload your information from the myDeductions tool in the ATO app if you have used it.

- Select Next

Step 4: Prepare your return

The ATO pre-fills information into myTax as it becomes available. You shouldn't rely solely on pre-filled information. You need to check all the information and add any missing information to ensure your tax return is accurate.

Income statements and payment summaries

- Select Add/Edit for income statements and payment summaries

- Enter 'Apprentice' in Occupation where you earned the most income

- Select APPRENTICE - ELECTRICIAN from the drop-down box

- Select Save and continue

Deductions

You will now need to enter some items that are allowable tax deductions relating to your employment

- Select Add/Edit for Deductions to enter your deductions.

Add the following deductions to the tax return.

Deduction category Deduction type Amount Add: Work-related clothing, laundry and dry-cleaning expenses Toolbelt

Select: Occupation-specific clothing

$65.45 Add: Work-related clothing, laundry and dry-cleaning expenses Safety boots

Select: Protective clothing

$124.45 Add: Work-related self-education expenses (The self-education maintained or improved a skill or specific knowledge required for your work activities as an employee) Select: Self-education type

- The self-education maintained or improved a skill or specific knowledge for your work activities as an employee

Select: General expenses

Enter: TAFE fees

$295 Add: Gift or donation Enter: Donation to World Vision $40.00 - When you have entered your deductions, select Save and continue.

Medicare and private health insurance

You will notice a 'Required' message under Medicare and private health insurance.

- Select Add/Edit and under Medicare levy surcharge (MLS) select 'Yes' you are covered by private patient hospital cover.

- You will notice a Private health insurance policy has been pre-filled but has an error. Select the drop-down arrow.

- At the BUP policy line 1 section:

- Enter Tax claim code 'A'.

- Enter $400 as Your premiums eligible for Australian Government rebate.

- Enter $100 as Your Australian government rebate received.

- Select Benefit code 30

- Select Save and continue.

Calculate Tax Estimate and Lodge

- Check that all your details are correct Calculate to generate your Tax estimate. MyTax gives you an estimate of how much tax you will be refunded, or if you have a tax bill.

- You now tick a box to sign a declaration that the information you have entered, including the pre-filled information, is true and correct, that you included all your income and you have the necessary receipts and records, including proof of your deductions.

- Select Lodge and print the tax return.

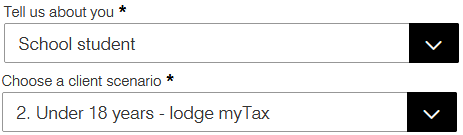

Scenario 4: Yourself

So now you get to have a go at completing a tax return yourself. The ATO has an online services simulator for educational purposes. This includes myTax. Open the ATO Online services simulator and follow these instructions.

- Select the options above on the landing page and select Start.

- This is the home page of ATO online services. Before you complete a tax return, browse the information you can access from this page.

- In the For action box you will see an Overdue message. It tells you that this taxpayer’s tax return is overdue. Select the Prepare link to complete this tax return.

You are now in myTax.

Step 1: Contact details

This is where you update your details if necessary. Note that myTax pre-fills the information. It is your responsibility to check it is correct and change it if it is not.

- Select Next.

Step 2: Financial institution details

You need to make sure this information is accurate, because if you are owed a refund, it will be deposited directly into this bank account.

- Select Next.

Step 3: Personalise your return

This is where you can personalise your return so you only complete the parts relevant to you. Information that has been reported to the ATO will be pre-filled with the corresponding checkbox selected. You can check the information on the next screen to ensure it is accurate. You can also upload your information from the myDeductions tool in the ATO app if you have used it.

- Select Next

Step 4: Prepare your return

MyTax has pre-filled the salary you earnt at MACDONALD FARM.

Income statements and payment summaries

- Select Add/Edit for income statements and payment summaries

- Enter your actual occupation or an occupation of your choice at Occupation where you earned the most income

- Select Save and continue

Deductions

You will now need to enter some items that are allowable tax deductions relating to your employment

- Select Add/Edit for Deductions to enter your deductions.

- Add some deductions you can claim from your actual job or might claim for your choice of employment.

- When you have entered your deductions, select Save and continue.

Medicare and private health insurance

You will notice a 'Required' message under Medicare and private health insurance.

- Select Add/Edit and under Medicare levy surcharge (MLS) select 'Yes' you are covered by private patient hospital cover.

- You will notice a Private health insurance policy has been pre-filled but has an error. Select the drop-down arrow.

- At the BUP policy line 1 section:

- Enter Tax claim code 'A'.

- Enter $400 as Your premiums eligible for Australian Government rebate.

- Enter $100 as Your Australian government rebate received.

- Select Benefit code 30

- Select Save and continue.

Calculate Tax Estimate and Lodge

- Check that all your details are correct Calculate to generate your Tax estimate. MyTax gives you an estimate of how much tax you will be refunded, or if you have a tax bill.

- You now tick a box to sign a declaration that the information you have entered, including the pre-filled information, is true and correct, that you included all your income and you have the necessary receipts and records, including proof of your deductions.

- Select Lodge and print the tax return.